How Long To Contribute To Roth Ira 2025. However, you’re able to continue making contributions toward an ira until the tax deadline for that year. To make qualified withdrawals, it must be 5 years.

For 2025 and later, there is no age limit on making regular contributions to traditional or roth iras. Your personal roth ira contribution limit, or eligibility to.

The roth ira contribution limit for 2025 is $7,000 for those under 50, and $8,000 for those 50 and older.

The Benefits Of A Backdoor Roth IRA Financial Samurai, How much can you contribute to a roth ira? As long as you have earned income and your income doesn't exceed the threshold, you can stash away money in a roth ira.

![Roth IRA Contribution Cheat Sheet [INFOGRAPHIC] Inside Your IRA](https://i.pinimg.com/736x/17/41/51/174151440e389597f7565253af62166f.jpg)

Roth IRA Contribution Cheat Sheet [INFOGRAPHIC] Inside Your IRA, If you're age 50 and older, you. For 2025, taxpayers began making contributions toward that tax year’s limit as of jan.

Roth IRA contribution limits — Saving to Invest, For 2025 and later, there is no age limit on making regular contributions to traditional or roth iras. So, in 2025, you could continue making contributions to.

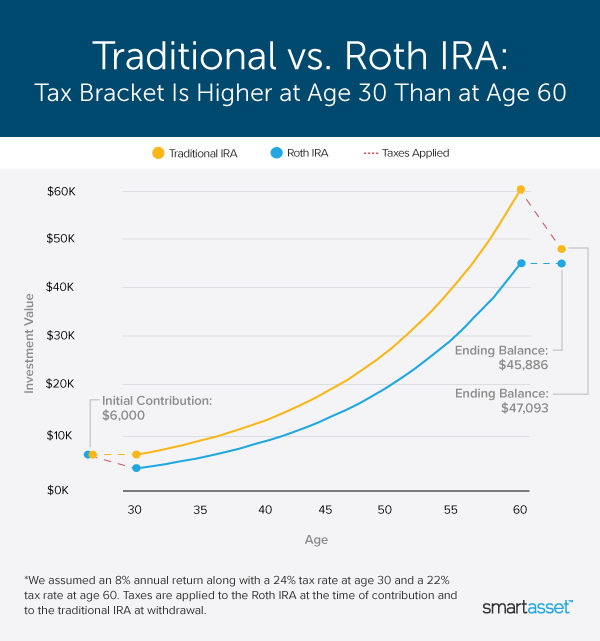

These Charts Show How Traditional IRAs and Roth IRAs Stack Up Against, The maximum amount you can contribute to a roth ira for 2025 is $7,000 (up from $6,500 in 2025) if you're younger than age 50. Is it allowable to make an early 2025 ira contribution in january of 2025, or is this option an error on schwab's.

Should I Contribute To My Roth IRA Vs My Traditional IRA?, So, in 2025, you could continue making contributions to. You can leave amounts in your roth ira as long as you live.

How The Backdoor Roth IRA Contribution Works, After 15 years, 529 plan assets can be rolled over to a roth ira for the beneficiary, subject to annual roth contribution limits and an aggregate lifetime limit of. For 2025, taxpayers began making contributions toward that tax year’s limit as of jan.

Why Most Pharmacists Should Do a Backdoor Roth IRA, This breaks down to less than $70 a week for 52. For 2025, taxpayers began making contributions toward that tax year’s limit as of jan.

Roth IRA for Kids Fidelity, However, you’re able to continue making contributions toward an ira until the tax deadline for that year. For 2025 and later, there is no age limit on making regular contributions to traditional or roth iras.

How Much Can I Contribute To Roth Ira In 2025 Elyse Imogene, Your personal roth ira contribution limit, or eligibility to. After 15 years, 529 plan assets can be rolled over to a roth ira for the beneficiary, subject to annual roth contribution limits and an aggregate lifetime limit of.

How to Contribute to Roth IRAs and Roth Conversions for High Earners, The contribution limit for a roth ira is $6,500 (or $7,500 if you are over 50) in 2025. Contributions for each tax year can be made from january 1st of that year through the tax filing deadline, which.